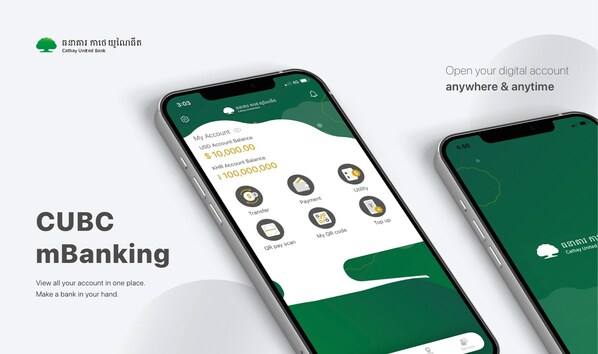

TAIPEI, April 10, 2023 /PRNewswire/ -- Cathay United Bank (Cambodia) Corporation Limited hereinafter referred to as "CUBC", a subsidiary of Taiwan's largest financial group Cathay Financial Holdings launched the new CUBC mobile banking application (mBanking App) integrated with the National Bank of Cambodia's Bakong payment system. This new mBanking App was created with the aim of providing a modern and convenient digital financial experience to customers in Cambodia. CUBC's new mBanking app allows customers to open digital accounts instantly.

Ms. Alice Chuang, president of Cathay United Bank (Cambodia) Corporation Limited said that, "In recent years, CUBC has continuously improved high-quality financial services, and upgrade customers' experience of the digital banking services at the same time. In addition to convenience and providing a new experience for users of mobile banking applications, CUBC is also integrated to National Bank of Cambodia's Bakong system."

With Bakong system, CUBC customers can transfer money to all Bakong members for free service of charge until July 30th, 2023. At the same time, CUBC customers can also deposit money into their accounts through financial agents that are members of Bakong. Currently Bakong has nearly 50 members such as Canadia Bank Plc., ACLEDA Bank Plc., True Money (Cambodia) Plc., Lyhour Pay Pro Plc and so on. Under Bakong membership, CUBC customers can also use QR code to receive and pay with other members.

According to a report released by Nikkei Asia, the number of users of the Bakong payment system (including those who also use apps of member banks connected to the system) has grown to some 7.9 million since the launch of the system in Cambodia in 2020, accounting for nearly half of the country's total population, with transactions totaling some US$2.9 billion in value.

With nearly 10 years of experience in Cambodia alongside its deep understanding of customers' expectations when it comes to digital payment and information security, CUBC released the mBanking App with the goal of delivering a streamlined, seamless and secure digital financial experience. "The CUBC mBanking App also integrates the Fast Identity Online (FIDO) authentication and facial recognition systems that enhance the security of personal digital accounts, preventing counterfeiting and forgery," added Alice Chuang. Going forward, CUBC plans to roll out new capital utilization and savings offerings to Cambodia's bank account holders as well as to the country's small and medium-sized enterprises (SMEs).

Download CUBC mBanking App and open a digital account to get a new customer welcome gift of $3 and chance to win other prizes

Furthermore, CUBC has a lot of special prize for new customers from 10th April 2023 until 10th July of 2023, CUBC is rolling out a series of offers whereby customers who download the CUBC mBanking App and open a digital account during the promotion period are entitled to receive a welcome gift of USD3 (1,500 units in total). Furthermore, customers who open digital account through mBanking App between 10th April 2023 till 10th July of 2023 are eligible for a lucky draw to win a number of compelling gifts, including a Honda Beat motorcycle in Latest model, iPhone 14 Pro Max and Apple Watch Series 8. For more information, please visit the company's official website. https://www.cathaybk.com.kh/event

About Cathay United Bank Cambodia (CUBC)

Since 2014, CUBC, a wholly owned subsidiary of Taiwan's largest financial holding company Cathay Financial Holdings, has established a network of 16 branches/outlet and 78 ATMs across major cities/provinces in Cambodia. The Bank plans to steadily develop its branch network and digital financial business throughout the country in addition to developing new financial solutions that meet the diversified needs of corporate and individual customers.

2 years ago

350

2 years ago

350

English (United States)

English (United States)