|

LONDON, July 20, 2023 /PRNewswire/ -- There are more than sufficient natural resources and minerals to meet the needs of a global zero-carbon energy system, and that system will impose a far smaller environmental impact on the world than today's fossil fuel based system. But, as the global Energy Transitions Commission highlights in its latest report, "Material and Resource Requirements for the Energy Transition", large investments and strong policy support are needed to ensure that the supply of some key minerals grows quickly and sustainably over the next decade to meet rapidly growing demand.

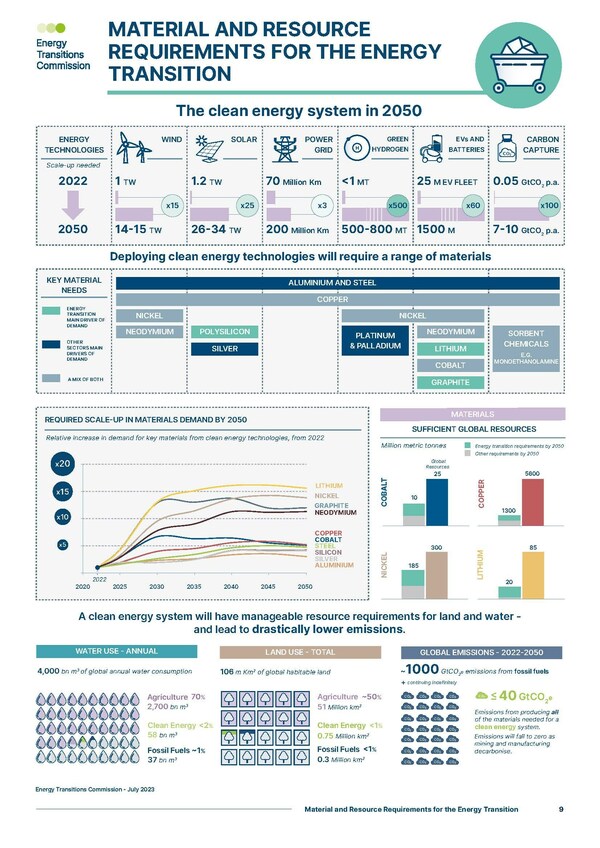

The future net zero emission economy will depend on huge increases in electricity supply and demand, rising from a global total of ~28,000 TWh in 2022 to over ~100,000 TWh by 2050. This will require massive deployment of solar and wind power capacity, a major expansion of electricity grids, and huge growth in the production of batteries and electric vehicles and electrolysers for green hydrogen production.

This new energy system will require significant resources of both land (primarily for solar PV farms) and water (used in the power system, carbon capture, and a range of mining and refining processes). But the total land and water requirements are similar to those required by the fossil fuel based system, and less than 3% of the land and water resources used by global agriculture.

Building the new energy system will also result in some initial CO2 emissions - the first generation of any new clean technology has to be built using fossil fuel based energy. But the production of materials to support the energy transition will result in total global cumulative life cycle emissions of 15-30 GtCO2e, compared with the ~40 GtCO2e produced every year from the current fossil-fuel-based energy system; and while the former will fall towards zero as the mining and refining sectors decarbonise, emissions from fossil fuels would continue in perpetuity if we do not transition to a new system.

So, while land and water requirements must be managed carefully, particularly in densely populated and water-stressed regions, and while life cycle emissions from material production must be minimised, the key challenges relate to the minerals and other materials required for the energy transition.

The scale of materials needed for the energy transition

Between 2022–2050, the energy transition could require the production of 6.5 billion tonnes of end-use materials, 95% of which would be steel, copper and aluminium, with much smaller quantities of critical minerals/materials such as lithium, cobalt, graphite or rare earths. This cumulative material extraction compares with the over 8 billion tonnes of coal currently extracted annually.

There is no fundamental shortage of any of the raw materials to support a global transition to a net-zero economy: geological resources exceed the total projected cumulative demand from 2022-50 for all key materials, whether arising from the energy transition or other sectors. The key issues are therefore:

Ramping up supply fast enough to decarbonise the global economy at the pace required. Ensuring mining for key materials occurs in a sustainable and responsible way which manages and minimises local environmental impacts."There are enough resources and minerals in the world for the energy transition. But in some key minerals – particularly lithium and copper – it will be challenging to scale up supply fast enough over the next decade to keep pace with rapidly rising demand. Governments, regulators, producers and consumers must work together to increase recycling, improve material efficiency, invest in new mining, and regulate environmental and social standards," said Adair Turner, Chair of the Energy Transitions Commission.

Rapid demand growth could lead to supply shortages in the next decade if four key challenges are not met

Without strong action to improve materials efficiency, increase recycling or increase mined supply, there could be significant supply gaps for six key energy transition materials: lithium, nickel, graphite, cobalt, neodymium and copper. This raises the risk that high prices could delay the energy transition.

Four actions must be taken to reduce that risk and expand supply quickly and sustainably:

Building new mines and expanding existing supply of materials quickly: large-scale mining projects can take 15-20 years, and the last decade has seen a lack of investment in exploration and production for key energy transition materials. Key solutions include accelerating permitting timescales, increasing output from existing mines, updating geological surveys and improving international data-sharing. Capital investments in key energy transition metals (excluding iron ore and gold) must rise from $45bn per annum to an estimated $70bn per annum through to 2030. Building more diverse and secure supply: Mining for certain key materials is heavily concentrated (e.g., 70% of cobalt production is from the Democratic Republic of Congo) and China dominates the refining of almost all key materials. Companies and countries should seek to build more geographically diverse supply chains and developed world governments should remove barriers to the domestic development of mining and refining activities – aiming to diversify and de-risk production, not achieve total decoupling. Sustainable and responsible material production: Key challenges include the carbon and water intensity of production; declining ore grades and waste rock production; the indirect deforestation and biodiversity impacts of mining in tropical regions; and social impacts on local mining communities including human rights concerns, labour standards and tax avoidance. Addressing these impacts requires companies to adopt best-in-class practices driven by strong regulations on carbon intensity and environmental impacts. Increased use of voluntary standards and supply chain traceability can also help increase monitoring and transparency. Reducing pressure on primary supply: Strong action to accelerate technology development, improve materials efficiency and increase recycling could reduce cumulative demand to 2050 by 20-60% for most materials, and technological innovation play a major role in closing specific supply gaps over the short term. Recycling will play a critical role from 2040 and beyond as the stock of clean energy technologies deployed begins to reach end-of-life."This is another brilliant analysis by the ETC. They show that the environmental impact of the renewable energy system is dramatically lower than that of the fossil fuel system, that we have enough minerals for the renewable revolution and that there are no insoluble barriers to change." said Kingsmill Bond, Senior Principal in the Strategy Team at Rocky Mountain Institute.

"Minerals are critical, but we must mine them as if they were not. Demand for minerals will grow dramatically in the next decades, and our shared goal must be to ensure that this is being met in a way which enables both people and the planet to thrive. The Energy Transitions Commission's report provides key analysis and data on material and resource requirements which will help the industry and key stakeholders ensure that the right conditions are in place to deliver the materials we need for the energy transition, while enhancing our industry's contribution to sustainable development." said Rohitesh Dhawan, President and CEO, International Council on Mining & Metals.

"Material and Resource Requirements for the Energy Transition" has been developed in collaboration with ETC members from across industry, financial institutions and environmental advocacy including Arcelor Mittal, BloombergNEF, EBRD, HSBC, Iberdrola, Impax, National Grid, Rio Tinto, Rocky Mountain Institute, Schneider Electric, Volvo Group, the World Resources Institute, Worley and Ørsted.

This report constitutes a collective view of the Energy Transitions Commission. Members of the ETC endorse the general thrust of the arguments made in this report but should not be taken as agreeing with every finding or recommendation. The institutions with which the Commissioners are affiliated have not been asked to formally endorse the report.

To read the full report, visit: https://www.energy-transitions.org/publications/material-and-resource-energy-transition

Notes to editors

For further information on the ETC please visit: https://www.energy-transitions.org

To access the report and accompanying Critical Raw Materials Factsheets visit: https://www.energy-transitions.org/publications/material-and-resource-energy-transition

View the ETC Commissioner list here.

1 year ago

410

1 year ago

410

English (United States)

English (United States)