|

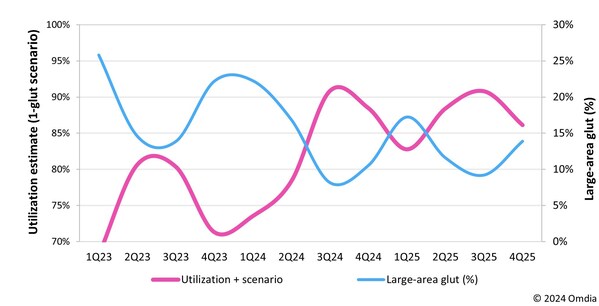

LONDON, May 23, 2024 /PRNewswire/ -- Over the course of the flat panel display (FPD) industry's history, factory utilization has typically averaged approximately 84%. However, from 3Q22 to 4Q23, as the FPD market struggled to recover from the post-pandemic glut, industry-wide loading dropped significantly to 70.7%.

With demand growth finally outpacing capacity expansion, it will enable large-area focused factory utilization to increase to almost 90% in 3Q24 and remain healthy in future years, as revealed in Omdia's recently released OLED and LCD Supply Demand and Equipment Tracker.

Utilization correlates closely with demand for panels, materials, panel prices, and profitability, and is therefore an important metric for analyzing the FPD industry. Thorough supply chain surveys generate accurate actual utilization and short-term forecasts. However, due to short material lead times, it's necessary to model longer-term utilization rates as a function of supply and demand.

"Large-area factory utilization averaged about 74% in 2022 and 2023. In 2024, panel area demand is expected to increase by 11%, as consumers continue to buy larger monitors and TVs when replacing older sets. The weighted average LCD TV size grew an incredible 2.9" in 2023. From 2024, LCD TV size is forecast to expand again by 1.6" and by another 1.1" in 2025. Larger panels combined with a 7% recovery in unit demand will support above 82% average factory utilization in 2024. Using supply/demand analysis scenarios, utilization is modeled to further increase annually to nearly 89% in 2026," commented Charles Annis, Practice Leader in Omdia's Display Research group.

Sharp's recently announced plan to close its SDP Gen 10 LCD factory in Sakai, Japan will significantly reduce available production capacity. It will lead to more balanced supply and demand as well as an increasing number of quarters where large-area utilization rises to 90% or higher.

"90% utilization is a sweet spot that supports firmer panel prices and encourages moderate capacity expansion. Finding this optimum balance between capacity, utilization, growth, and prices to maximize profitability is both the goal and the challenge for FPD supply chain companies as the industry matures," concludes Annis.

ABOUT OMDIA

Omdia, part of Informa Tech, is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

Fasiha Khan: Fasiha.khan@omdia.com

10 months ago

296

10 months ago

296

English (United States)

English (United States)