MELBOURNE, Australia, Oct. 27, 2022 /PRNewswire/ -- The strong performance and innovative use of financial instruments by digital asset investment specialist Zerocap has been recognised as Zerocap's Smart Beta Bitcoin strategy for wholesale investors was awarded Finder's "Best Digital Currency Innovation" award.

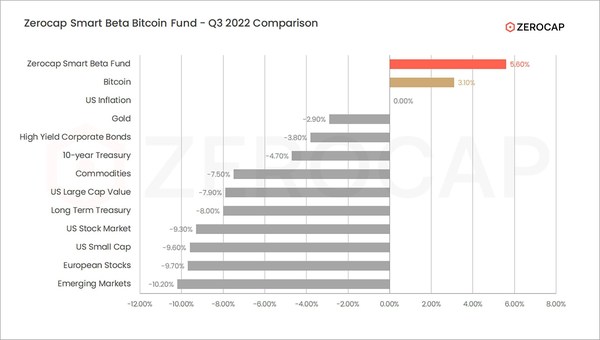

Zerocap's Smart Beta Bitcoin Fund returned 5.6% in Q3 2022, an outstanding return in challenging markets that bested virtually all other asset classes in the quarter including Bitcoin itself, US equities, European equities, gold, commodities, and corporate bonds.

Whilst investing in cryptocurrencies and digital assets, including Smart Beta Bitcoin Fund, involves considerable risks, Zerocap managers deploy proprietary models for the Smart Beta Bitcoin Fund that rebalance the high volatility of Bitcoin to lower levels, in line with risk profiles of equity portfolios. The objective of Smart Beta Bitcoin is to reduce and balance risk while actually improving risk adjusted returns, all while providing exposure to Bitcoin. Zerocap's Chief Investment Officer Jonathan de Wet said,

"Our approach has paid off, demonstrating that there is a place for this product in well designed portfolios. Smart Beta allows us to maintain an amazing risk-adjusted return profile, but without the volatility".

Zerocap's Head of Trading Toby Chapple said "Based on traditional investment banking techniques developed to cure hedge fund risk profiles, Smart Beta Bitcoin uses a proprietary and rigorous methodology to redistribute risk regularly between Bitcoin and a cash equivalent digital asset to accurately control the swings in the price of Bitcoin to a predetermined level. The product allows investors to control the downside risk of their investments whilst having all the statistical benefits that the asset class offers to a portfolio approach to investing."

About Zerocap

Zerocap's mantra is zero friction, borderless finance. Zerocap is Australia's leading full-service crypto platform, providing tailored investment products and secure digital custody to a global client base of wholesale investors, institutions, HNWs and family offices.

Zerocap creates bespoke solutions for investors to build and diversify their investment portfolio with digital assets, through a range of regulated and direct exposure products across the volatility spectrum to fit with their desired levels of investment and risk.

Zerocap's people bring a deep understanding of digital asset technology, trading, and portfolio optimisation, having processed a billion dollars of digital assets for private investors, family offices and institutions. Zerocap has assembled a team of blockchain experts, institutional portfolio managers and advisers, and experienced traders; backed by strong compliance, security and reporting functions.

Zerocap provides market leading institutional grade digital custody and storage facilities backed by insurance policies for all its investors, utilising best-in-class technology such as MPC cryptography and hardware isolation.

This material is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any digital asset. Investments in digital assets can be risky and you may lose your investment. Past performance is no indication of future performance.

This material is issued by Zerocap Pty Ltd (Zerocap), a Corporate Authorised Representative (CAR: 001289130) of Gannet Capital Pty Ltd (GC) AFSL 340799.

2 years ago

601

2 years ago

601

English (United States)

English (United States)